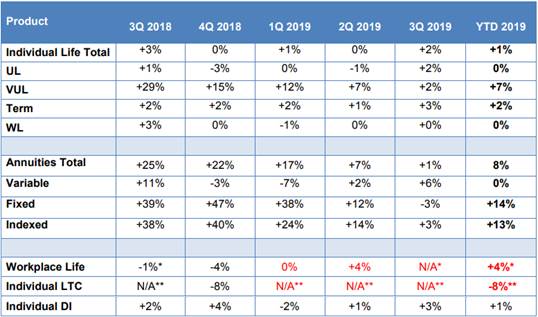

LIMRA released its Premium Life insurance Growth Rates Chart for Q3 and year-to-date 2019 sales. This chart provides details on new annualized premium growth rates for specific products over the past four quarters.

Preliminary Premium Growth Rates: Q3

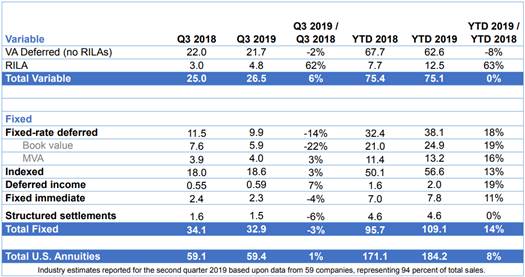

Total annuity sales increased 1% in Q3, to $59.4 billion. Year-to-date, total annuity sales were $184.2 billion, an increase of 8%, compared with the prior year. Despite an unfavorable interest rate environment, fixed annuities continued to represent the majority of the annuity market with 55% market share in Q3, which is down 4 percentage points from Q2.

Annuity Sales Estimates

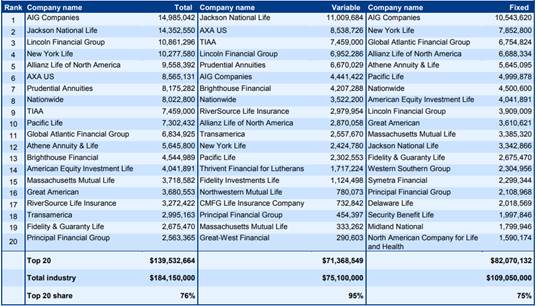

Individual Annuity Sales: Q3

($ in thousands)

Fixed indexed annuity sales were $18.6 billion, 3% higher than Q3 2018. Year-to-date, FIA sales were $56.6 billion, 13% higher than the same period in 2018. “Following a record-breaking quarter for FIA sales, market conditions dampened demand for FIAs,” said Todd Giesing, research director, SRI Annuity Research (formerly LIMRA). “Given the low-interest-rate environment and the impact it had on cap rates to accumulation-focused products, we expect to see a greater portion of FIA sales to shift to guaranteed income products in the next several quarters.”

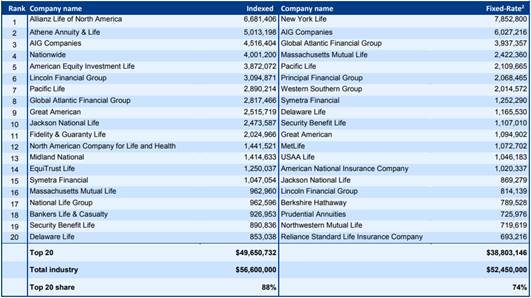

Individual Annuity Sales: Fixed Breakout Q3

($ in thousands)

See more information in the article and view more graphs here.