by Brittany | Feb 14, 2020 |

This detailed examination of 10 companies is comprehensive.

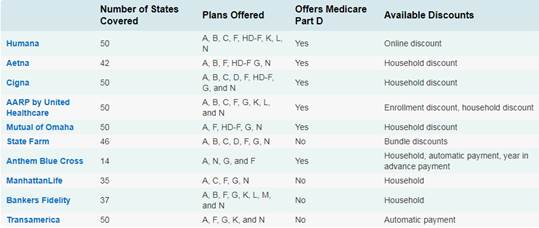

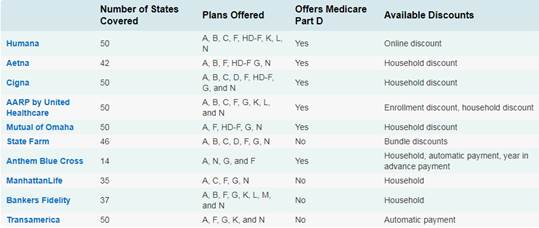

We created a guide profiling the best Medicare Supplement companies in the United States: the rankings include details about available plans, pricing models, customer service practices and additional benefits. These rankings make clear the strengths and weaknesses of each option:

View more information here.

by Brittany | Feb 14, 2020 |

According to the Federal Reserve, many adults struggle to save for retirement, and less than two-fifths feel that they are on track with their savings. Generally, preparedness for retirement increases with age, but concerns about inadequate savings are still common for those near retirement age. Congress is considering ways to address these concerns and it begins with the SECURE Act (The Setting Every Community Up for Retirement Enhancement Act).

The SECURE Act is designed to help more people save for retirement.

Research has shown that one of the most effective ways to get people to save is through access to a workplace retirement plan. This potential new legislation would remove some of the barriers preventing millions of Americans from having access to such plans. The bill recently gained traction with bipartisan approval in the House, 417-3 vote and now going on to the Senate, where it’s expected to move forward.

As Part of the SECURE Act:

- Small businesses would have more avenues to offer retirement plans to their employees

- Part-time workers would get access to 401(k) accounts

- The use of annuities would increase in retirement accounts

- Raises the age Americans must start drawing from retirement savings, from 70½ to 72

- Provides more years for people to contribute to individual retirement accounts

There are many other noteworthy details listed in the act, such as penalty-free withdraws under certain conditions. To read full details about the SECURE Act go to:

https://www.congress.gov/bill/116th-congress/house-bill/1994.

For nearly 50 years, AmeriLife has offered insurance and retirement solutions to provide peace of mind and help people live longer, healthier lives. We are following the SECURE Act closely and will be providing additional information as this Act continues to move forward.

by Brittany | Feb 14, 2020 |

More than half of seriously ill Medicare beneficiaries face financial hardships with medical bills, with prescription drug costs the leading problem, according to a study published Monday. All told, 53% of seriously ill Medicare patients said they had major trouble paying their medical bills. More than a third reported using all or most of their savings to pay medical bills; 27% said they were contacted by a collection agency; and 23% were unable to pay for basics such as food, heat and housing.

“Out-of-pocket costs are very concentrated,” said Anne Kyle, lead author of the study. “The sickest population is also getting the biggest bills. Especially if you are sick over time, you are slowly draining your bank account.”

Read the full article here and check out the infographic here.

by Brittany | Feb 14, 2020 |

We love our excuses. They provide us all the reasons we need not to be or not to do something. Your disempowering stories about your life prove that no one should expect you to be able to do something based on past events and the all-too-handy labels society provides for you, should you accept them. We keep the story alive because it absolves us of responsibility to be something more or do something more, something bigger, something more significant. How long will you define yourself by what you can’t do because something happened in the past, or you allowed someone to provide you with an identity based on something they believe – and something you could easily reject?

Read the full article here.

by Brittany | Feb 14, 2020 |

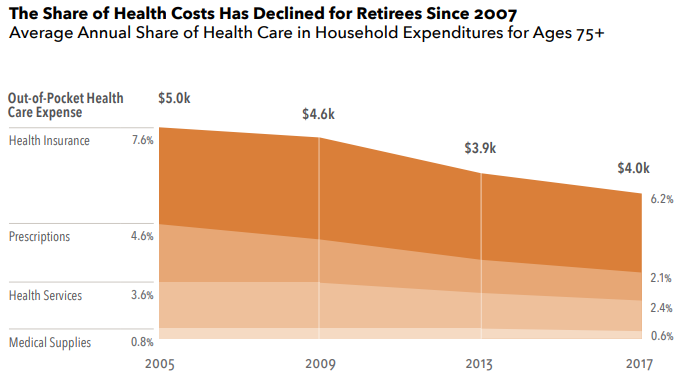

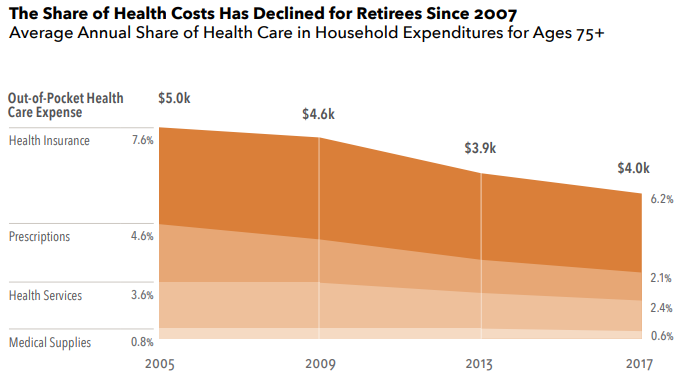

The Employee Benefit Research Institute examined the spending patterns of those in preretirement (50-64), early retirement (65-74) and late retirement (75+). It found spending tends to decrease over time, and the proportion across spending categories also changes. In general, retiree spending declines during retirement. While housing remains the largest spending category for every age group, older households allocated a smaller share of their budgets to transportation and entertainment and a larger share of their budgets to health care costs. However, the average annual share of health costs for the 65–74 and 75-or-older age groups declined after 2007, the year after Medicare Part D went into effect.

The breakdown of the out-of-pocket health care costs for those 75+ indicates most of the drop in total health costs for this age group is attributed to health insurance and drugs; other components remained largely unchanged.

Click to view the full document.